Every business should have access to an HMRC Business Tax Account whether the business operates as a sole trader, partnership, or a limited company. Whether you need to repay VAT that you deferred due to COVID or make a furlough claim – you will need a Business Tax Account to do this.

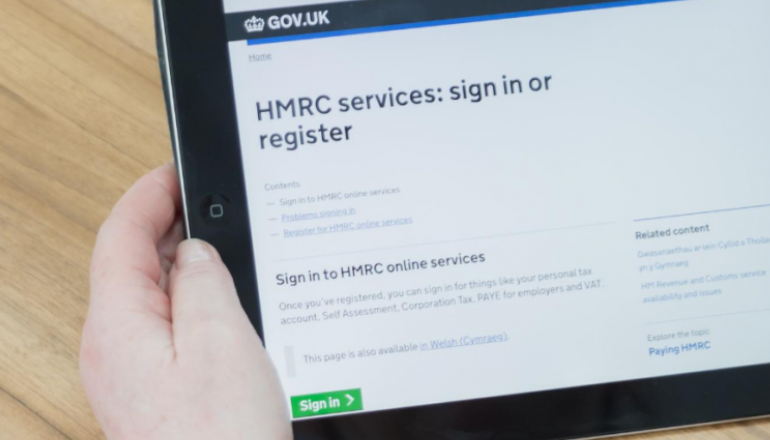

As a lot of services are shifting to rely more on digital and/or cloud-based communications with HMRC, it is now required that every business signs up and knows how to access their own Business Tax Account. If you don’t already have a Business Tax Account, we have outlined the process below that gives you step-by-step instructions on how to set one up.

What is a Business Tax Account?

A business tax account is a portal that allows sole traders, partnerships, and limited companies to access all their business taxes in one place and access an overall view of all their tax position for:

- Self Assessment

- PAYE

- VAT

- Corporation Tax

- other business taxes (see HMRC’s guidance on your business tax account here).

How do I create a Business Tax Account?

In order to create your own Business Tax Account, you will first need to generate your government gateway ID. To do this:

- Visit https://www.gov.uk/log-in-register-hmrc-online-services

- Click the green Sign In button.

- Scroll to the bottom of the page and click ‘create sign-in details’.

- Input your email address. You will receive a confirmation code via email that you’ll need to complete the process.

- Once you have received and inputted the code, enter all other requested details.

- You will then be given your own unique government gateway identifier. Please make a note of this and keep a safe record, however, you should also receive it via email.

To set up a Business Tax Account, you will then need to choose the type of account you require. You will need to choose ‘Organisation’. That’s it! You should then be taken through to the homepage of your Business Tax account.

Once a Business Tax Account has been set up, it can be used for accessing a range of HMRC services including Customs and Excise Duties, Imports, VAT, Corporation Tax, Construction Industry Scheme, PAYE for Employers, EC Sales lists and Pensions for Employers.

Please note, even if we are your authorised agents, your own account is still required in order to receive communications from HMRC which will no longer be sent to us as your agents.

For more information, contact your usual HB&O advisor on 01926 422292