If you operate a VAT registered business within the building and construction industry, you will likely have heard about the ‘Domestic Reverse Charge’ which will change the way VAT is to be collected.

Initially, the new legislation was due to be implemented from 1st October 2019 however, due to a lack of guidance from HMRC, pressure from industry experts, and more recently the impact of the coronavirus, the implementation had been delayed until March 2021.

There have been no further delays announced, therefore the Domestic Reverse Charge will come into force next month and it is vitally important that businesses consider the changes and understand how they may be affected.

What is the Domestic Reverse Charge?

Currently (before 1 March 2021), when a VAT registered contractor or subcontractor carries out work, they will invoice the customer the cost of the work carried out, plus the respective VAT, then pay the VAT on to HMRC. If the customer is also VAT registered, they are able to claim back the VAT that they have paid.

However, under the Domestic Reverse Charge rules (applicable after 1 March 2021), the customer will pay the VAT directly to HMRC rather than paying to the supplier. The customer can still recover the VAT paid to HMRC as input tax, if applicable.

The new legislation applies to services subject to standard rate or reduced rate VAT provided to VAT registered businesses or individuals in the UK, however zero-rated supplies are not affected.

HMRC has an hour-long webinar explaining the Domestic Reverse Charge in detail (please note, the implementation date in the webinar states October 2020, however, this has been extended to 1 March 2021). You can watch the HMRC webinar here. You will need to enter your name and email address to access the webinar, however, this provides an in-depth explanation on the subject.

If you would like some individual guidance on navigating the changes, please don’t hesitate to contact us.

Who is affected?

The new legislation will affect individuals or businesses that are registered for VAT in the UK and supplying or receiving specified supplies that are required to be or are reported under the Construction Industry Scheme (“CIS”) and are subject to CIS Deductions.

HMRC has detailed a full list of when to use and when not to use the Domestic Reverse Charge.

The reverse charge does not apply to:

- Consumers or final customers (these can be other businesses) as they are not making an onward supply of the building and construction services in question.

- VAT & CIS registered traders that are connected or linked to the ‘end user’ (either by sharing a relevant interest in the same land or are part of the same corporate group or undertaking)

- Employment agencies as these organisations supply labour, not the construction services themselves.

Six practical steps to prepare for the Domestic Reverse Charge

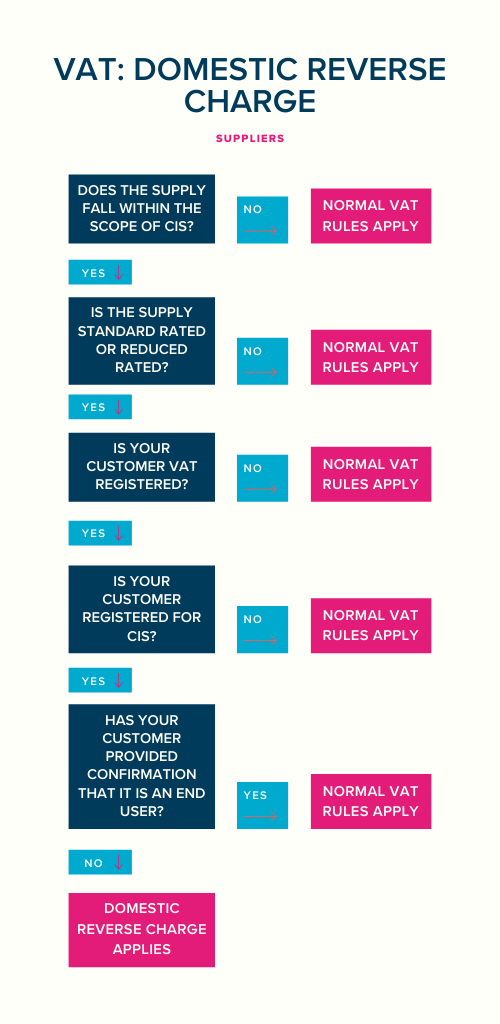

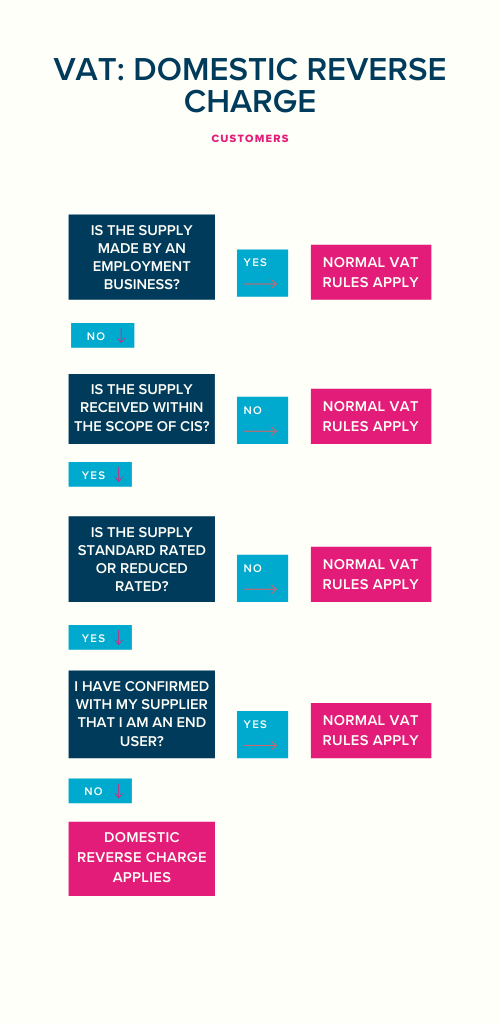

- Check whether the Domestic Reverse Charge affects your sales and/or your purchases. Use the supplier and customer flow charts below to help you decide if your services will be caught under the Domestic Reverse Charge. It’s important to be vigilant when checking invoices once the new rules come into force to ensure that you are not incorrectly charged VAT on the supplies subject to the Domestic Reverse Charge rules.

- If you are a sub-contractor, obtain confirmation from your customers on whether they are an end-user or intermediary connected with an end-user. If so, the Domestic Reverse Charge rules may not apply and the supplies, in this case, should be invoiced under the current VAT rules.

- Ensure that your accounting software has been updated to deal with the Domestic Reverse Charge procedure. Xero has a guide here on how to activate the update, or if you need support, contact our team who can help you get updated.

- Check that your invoices meet regulatory requirements to ensure compliance.

- Make sure your whole team is educated about the changes, especially those who will are involved with invoicing.

- Keep a close eye on your cash flow and plan for increased outgoings due to the changes. For suppliers, the introduction of the Domestic Reverse Charge may have a negative effect on cash flow as they will no longer receive the VAT from the customer, which, theoretically under normal VAT rules, they could have in their bank account for up to three months before having to pay it over to HMRC.

If you are unsure if you will be affected by the Domestic Reverse Charge, or have any queries in relation to the changes, please contact Neil Allcroft or Jess Mason on 01926 422292.