A change to the way HMRC manages the clearance of central assessments

HMRC have introduced a significant change to the way in which it manages the clearance of centrally issued assessments and it can catch a taxpayer out. When taxpayers miss the deadline for filing a VAT return, a ‘central assessment’ is raised automatically by HMRC’s system. This is also known as a ‘VAT notice of assessment […]

What is the UK Internal Market Scheme (UKIMS) and how do you register?

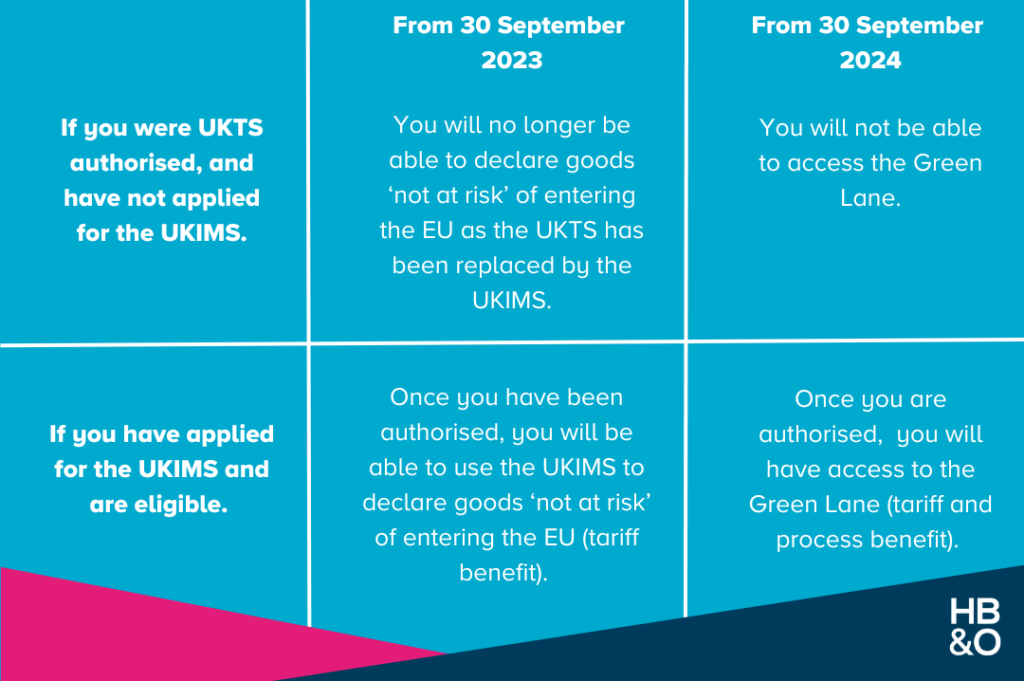

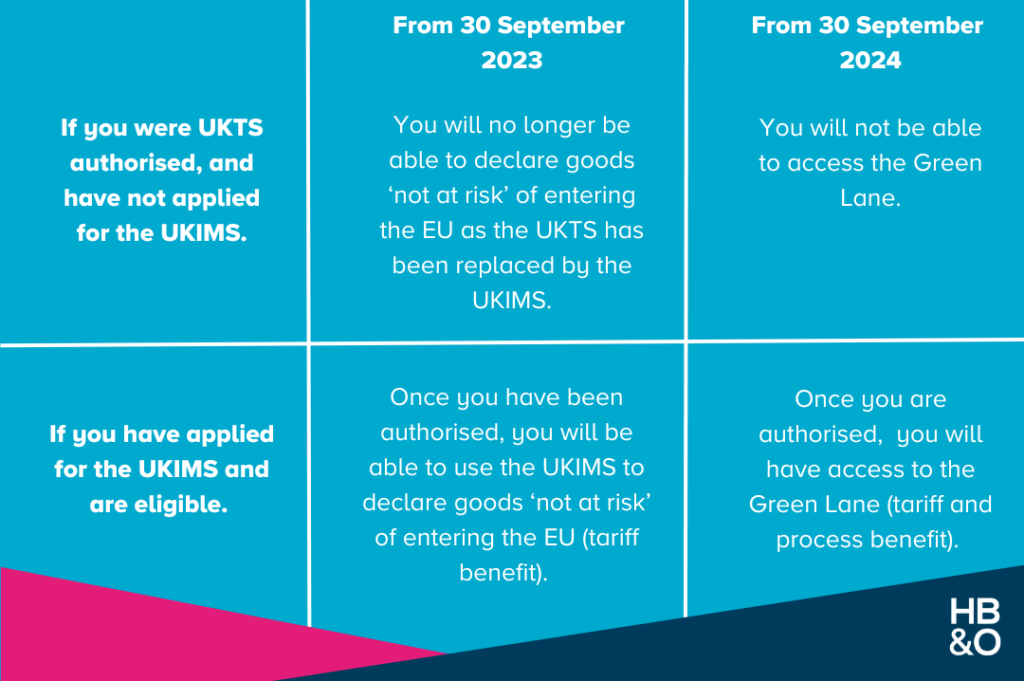

Following the implementation of the arrangements outlined in the Windsor Framework, an enhanced UKIMS has been established to replace the existing UK Trader Scheme from 30 September 2023. Goods moving before this date are able to be declared as ‘not at risk’ under the UK Trader Scheme. After 30 September, the UK Trader Scheme will […]

What is the Windsor Framework and what does it mean?

How will the Windsor Framework affect the movement of goods between Great Britain (GB) and Northern Ireland (NI)? The Windsor Framework is the culmination of ongoing negotiations which were concluded on 27 February 2023. The new Framework, which makes changes to the Northern Ireland Protocol, has been designed to enable better trading arrangements and movement […]

How to use the ‘Time to Pay’ arrangement for VAT

How to use the ‘Time to Pay’ arrangement for VAT The introduction of the new penalty regime for VAT in 2023 made it clear that HMRC believes that all VAT registered persons have a responsibility to account for and pay over the VAT that they have collected from their customers during the course of carrying […]

When should I register my company for VAT?

When should I register my company for VAT? Sorting out your tax registrations is one of the first things to tick off your to-do list as a new business owner. But knowing when to register for things like value-added tax (VAT) can be a confusing process for new entrepreneurs.Here’s a straightforward summary of what you […]

Upcoming changes to VAT penalties from 1 January 2023

HMRC is introducing a new VAT penalty regime which comes into effect from January 2023. This will change the way that penalties are issued for submitting late VAT returns and paying VAT late. This signals real change and is designed to be fairer, with repeat offenders of late filing and non-payment of VAT returns being […]

VAT cut on energy efficient materials- Spring Statement 2022

With effect from 1st April 2022, the Government have implemented temporary measures to zero-rate VAT applicable on the installation of qualifying energy-saving materials and heating equipment. The changes were announced in the Chancellor’s Spring budget, in a move set to financially incentivise energy efficiency in homes, amid the rising cost of energy prices and ‘green’ […]

Have your say on the proposed introduction of the new Online Sales Tax

HMRC is seeking consultation on its proposal to introduce an online sales tax (OST), which it believes could address imbalances between the taxation of the retail sector businesses operating wholly online compared to those operating in store specifically in relation to funding business rates reductions for those operating through physical outlets. It should be noted […]

Changes to Making Tax Digital for VAT from 1st April 2022

Who will be affected? Under previous guidelines, only businesses whose taxable turnover met or exceeded the VAT registration threshold were required to register for Making Tax Digital (MTD). However, HMRC have extended requirements to smaller VAT business which will come into force from the first full VAT period starting on or after 1st April 2022. […]

Changes to the temporary VAT rate for tourism and hospitality – what happens next and how you can make a VAT saving

What is the reduced rate of VAT? Last year, the Government introduced a temporary reduced rate of VAT to supplies of catering, holiday accommodation and admission to attractions (see our blog post on VAT reduction for hospitality). The reduced rate of 5% therefore applies the tourism and hospitality sector with effect from 15th July 2020. […]

VAT Reduction for Hospitality: how does it actually work in practice?

In the Budget in early March, Rishi Sunak announced that the VAT rate cut, from 20% to 5%, introduced in July 2020, which saw certain businesses working within the hospitality sector benefiting, was to be extended for six more months. What does the 5% VAT reduction apply to? The temporary reduction applies to businesses who […]

Domestic Reverse Charge for VAT: 6 Practical Steps to Prepare

If you operate a VAT registered business within the building and construction industry, you will likely have heard about the ‘Domestic Reverse Charge’ which will change the way VAT is to be collected. Initially, the new legislation was due to be implemented from 1st October 2019 however, due to a lack of guidance from HMRC, pressure from […]