How does PAYE work?

Are you taking on your first employees? Do you know your pay-as-you-earn (PAYE) requirements? We’ll help you set up your payroll and get your PAYE up and running. Once you become an employer, you’ll need to set up a pay-as-you-earn (PAYE) scheme. All businesses that employ people earning above the National Insurance (NI) lower earnings […]

5 myths stopping you from switching your accountant

A survey carried out in 2019 suggested that as many as seven in ten businesses were unhappy with their accountant. But just a quarter (27%) said they would up and leave for a new accountancy firm. The survey of 1,500 small businesses by Xero found that a third (34%) of SMES would actively tell people […]

Supporting your business as furlough ends

1 in 16 firms have said they’re at risk of closure due to Covid-19. Careful financial planning is crucial to mitigate the damage the pandemic has caused. Former prime minister Gordon Brown recently said that ‘a new job crisis point is approaching as furlough ends’. While this claim’s validity remains to be seen, what is […]

Understanding Annual Investment Allowance & Super Deduction

Changes to the annual investment allowance and the introduction of the super-deduction tax policy have had a big impact on tax allowances. Keep up to date here! The annual investment allowance (AIA) increase has been a blessing for many businesses when looking to weather the pandemic. If you’re unfamiliar, the AIA is a tax relief […]

How do I know if a letter from HMRC is genuine?

There are signs you can look for to help spot possible bogus communication from HMRC

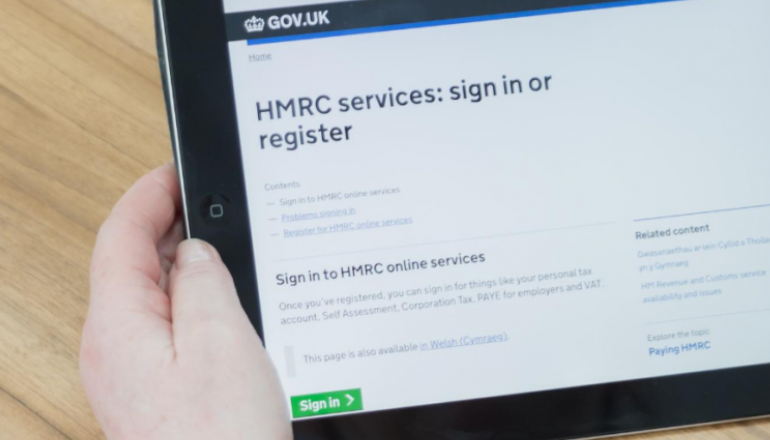

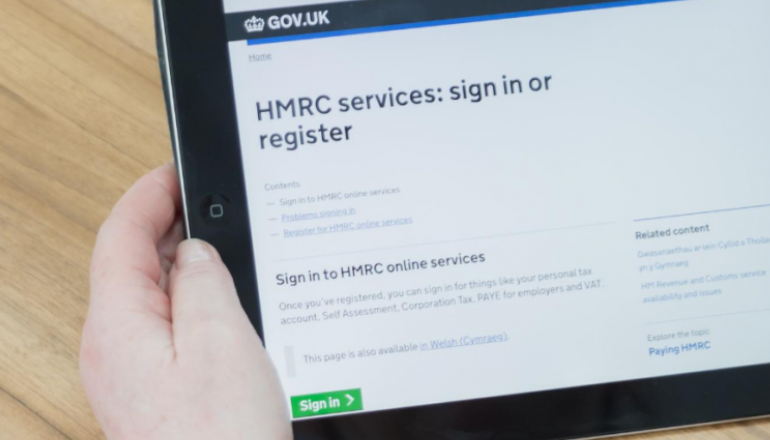

Making an HMRC Business Tax Account

Every business should have access to an HMRC Business Tax Account whether the business operates as a sole trader, partnership or a limited company.